|

|

|

|

|

|||

|

|||

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

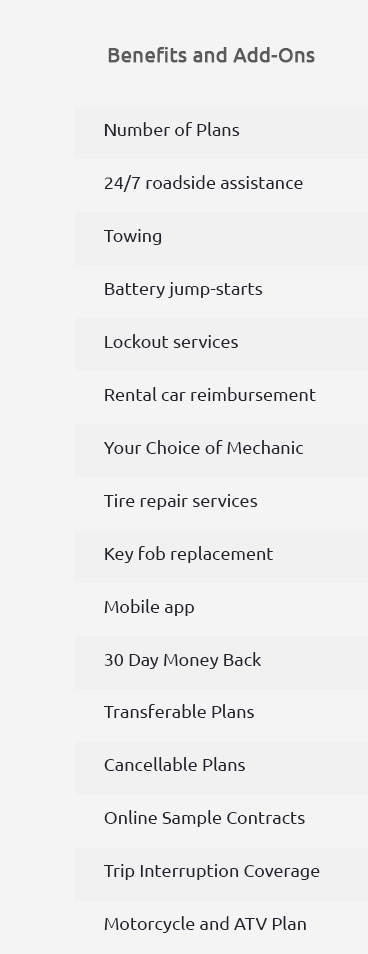

Purchase Gap Insurance: A Comprehensive Coverage GuideWhen you buy a new car in the U.S., understanding the various forms of insurance is crucial for financial protection. One of these essential coverages is gap insurance. This type of insurance covers the difference between the amount you owe on a car loan and the car's actual value if it's totaled or stolen. Let's explore why purchase gap insurance is beneficial for U.S. consumers. Why Consider Gap Insurance?Gap insurance offers significant peace of mind. New vehicles depreciate rapidly, often losing 20% of their value in the first year. If an unfortunate event occurs, your standard insurance might not cover the remaining loan amount, leaving you financially vulnerable. Benefits of Gap Insurance

Understanding What's CoveredGap insurance covers the disparity between what your vehicle is worth at the time of an accident and what you still owe on the auto loan. This coverage is particularly useful in cities like Los Angeles and New York, where high vehicle theft rates are a concern. It's a smart choice for vehicles financed with low down payments or long loan terms. Who Should Get Gap Insurance?Consider this insurance if:

For those looking into additional protections, consider the GM extended warranty cost for insights into extended auto warranties that can further safeguard your investment. Exploring Extended Auto WarrantiesAlongside gap insurance, an extended auto warranty can enhance your vehicle protection plan. An extended warranty covers repair costs beyond the manufacturer's warranty, providing extra security against unexpected expenses. Benefits of an Extended Auto Warranty

For more details, explore the first extended auto warranty for tailored coverage options. FAQ SectionWhat exactly does gap insurance cover?Gap insurance covers the difference between your car's actual cash value and the remaining balance on your loan or lease if your car is totaled or stolen. Is gap insurance necessary for leased vehicles?Yes, gap insurance is highly recommended for leased vehicles as it covers the lease amount you owe if the car is totaled or stolen. How do I purchase gap insurance?You can purchase gap insurance through your auto insurer, dealer, or as part of your auto loan agreement. https://www.freeway.com/auto-insurance/coverage/gap/

Typically, you can purchase it from the bank or financial institution that loaned you the money for your vehicle, the dealer or your insurer. Get GAP Insurance ... https://www.umecreditunion.com/borrow-insure/gap-insurance/

Yes, your local credit union is a great choice to be your GAP Insurance provider and UMe makes it super duper easy to purchase GAP insurance in California! https://www.acg.aaa.com/aaa-connect/understanding-car-gap-insurance.html

Cost and Acquisition of Gap Insurance - Dealerships: While convenient, purchasing gap insurance through a dealership may not always be the most cost-effective ...

|